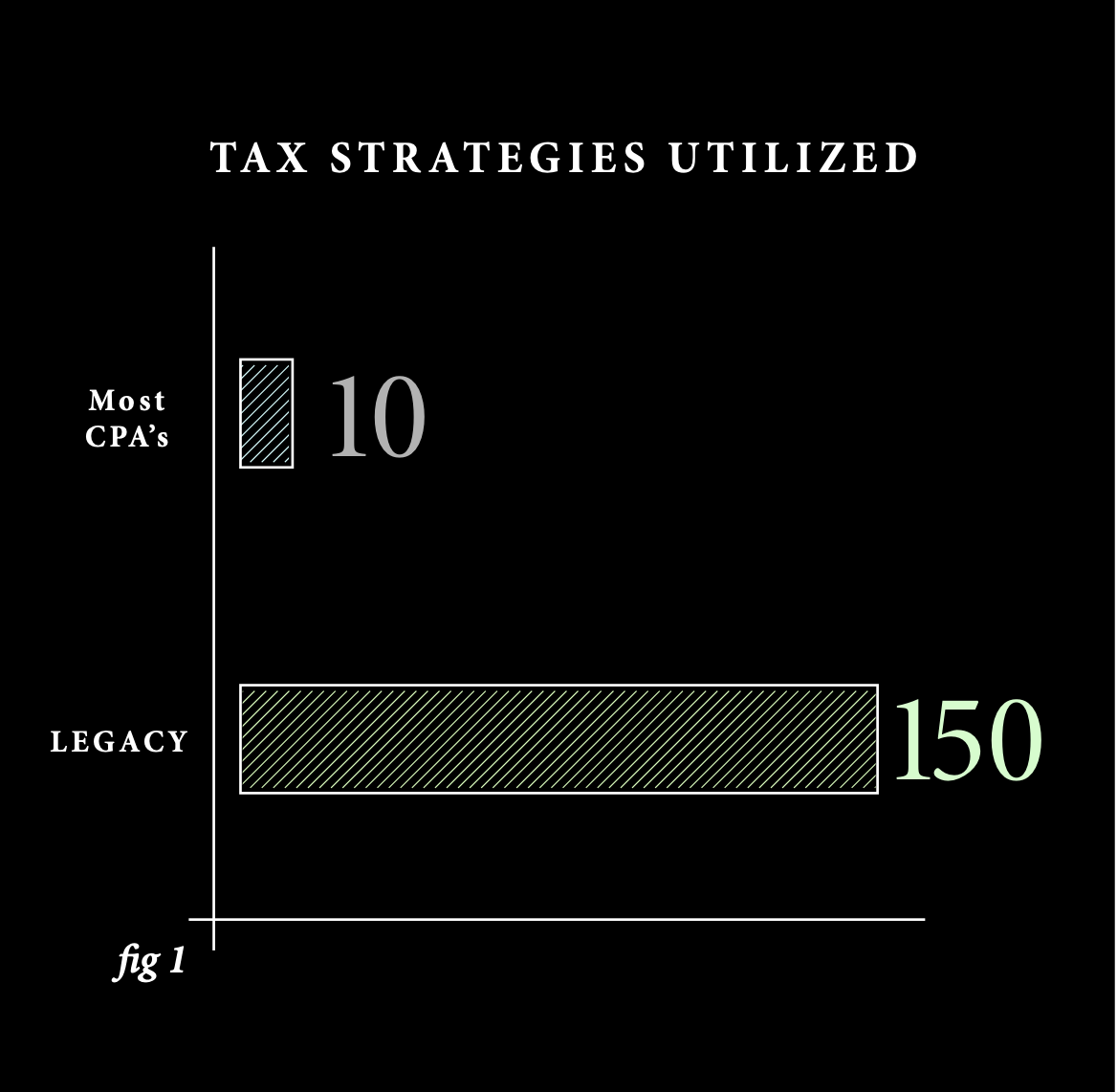

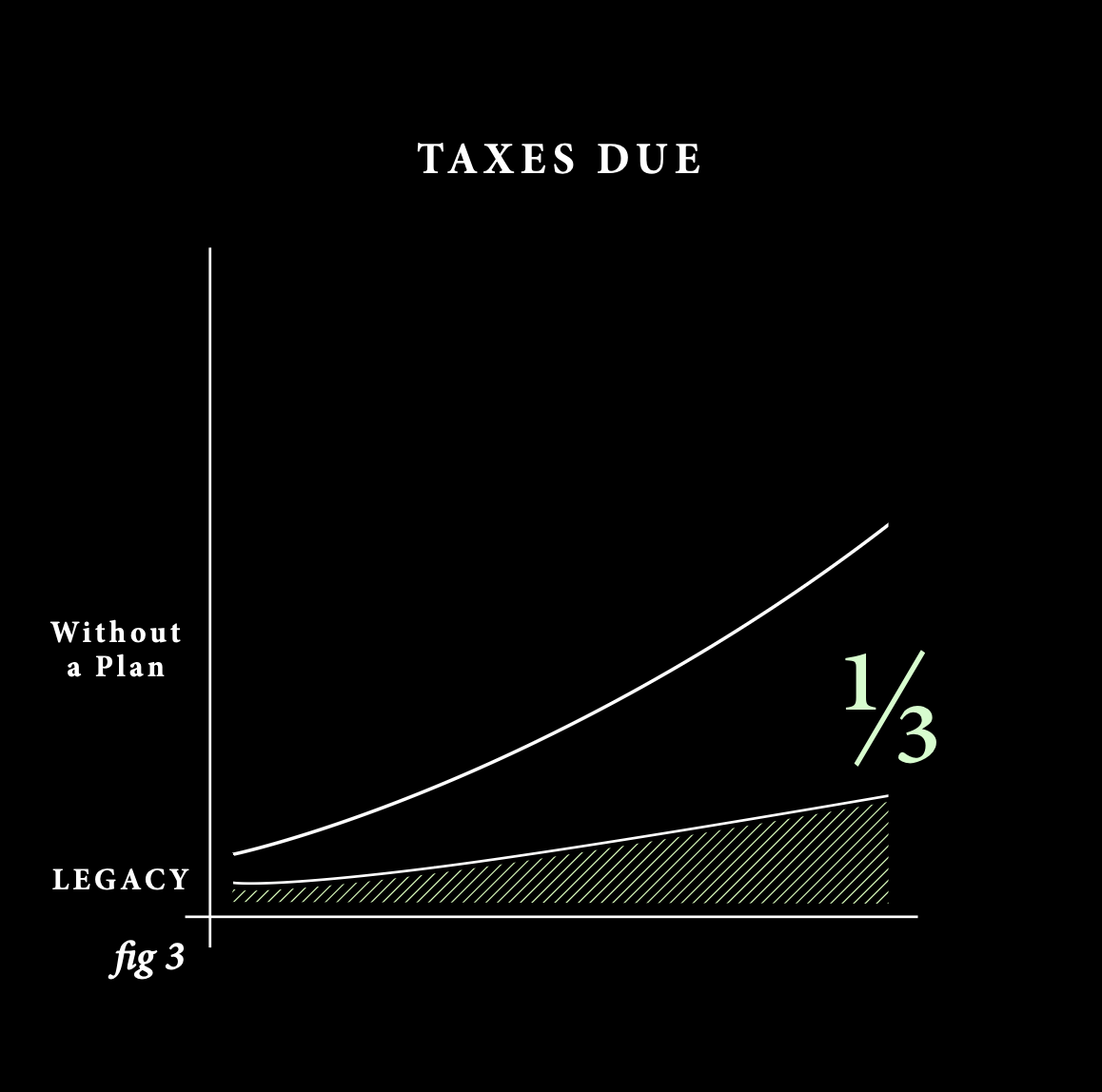

LOWER EFFECTIVE TAX RATES

Our Core Strategies focus on lowering your effective tax rate, year over year. Depreciation maximization, loss-harvesting, accelerated deductions, and numerous proprietary tax concepts will reduce your tax drag.

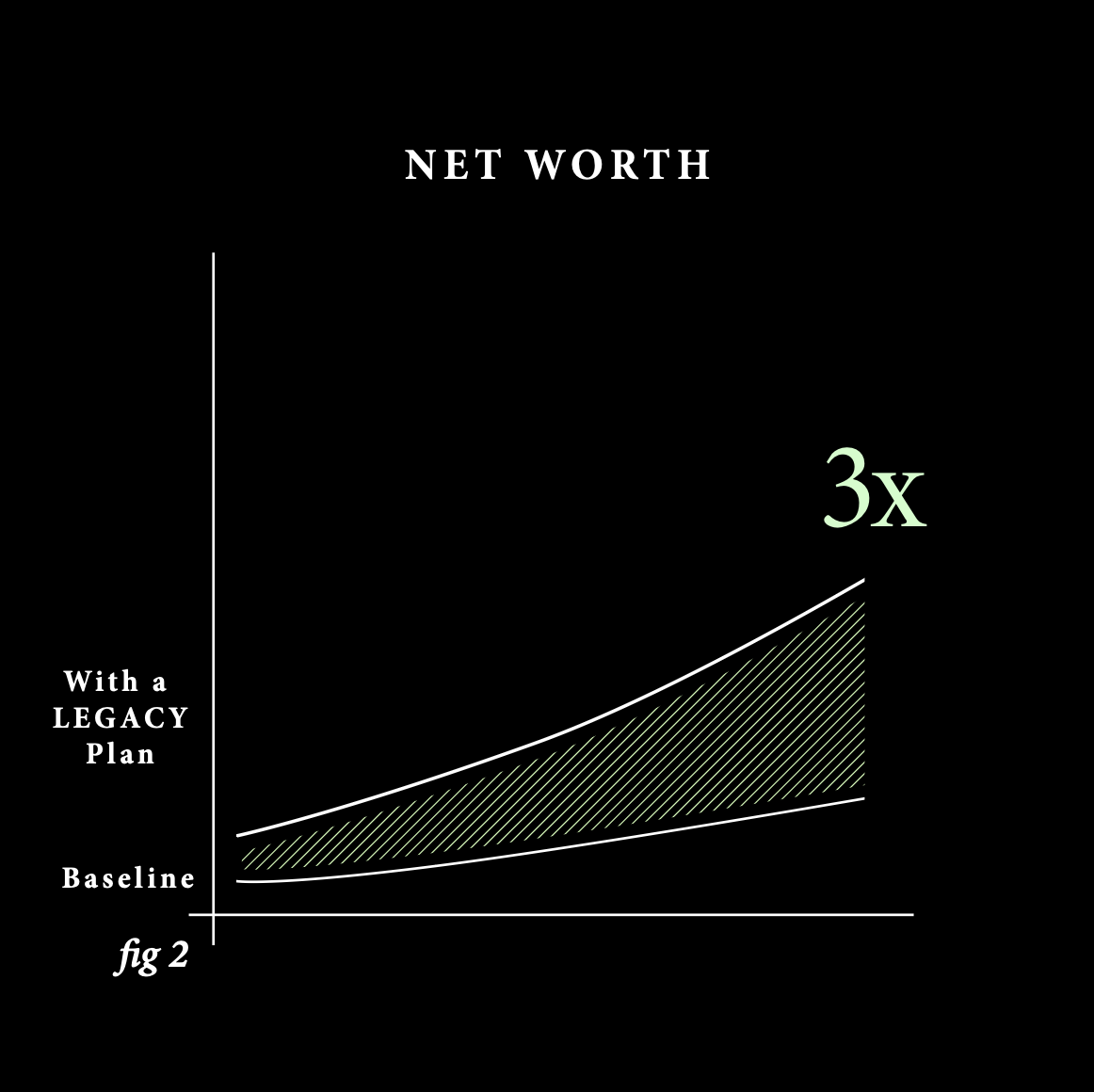

INCREASED NET WORTH TRAJECTORY

By lowering your tax burden through both permanent and deferred strategies, you will see an increase in your net worth trajectory that begins to grow exponentially over time.

MORE MONEY FOR THE THINGS YOU ENJOY

Many of our clients see an increase in their spendable cash. Many of our legacy strategies focus on creating liquidity from long-term, low-basis assets. Giving you spendable money to enjoy your life with.

Case Studies

BONUS DEPRECIATION

Bonus depreciation is the single most powerful tool ever created by Congress. It comes with many pitfalls and traps, however, such as excess business loss limitations, passive loss limitations, and 1631(j) interest expense limitations, among others. We carefully measure each depreciation strategy and election to maximize proper use of the tool.

SECTION 1202 SMALL BUSINESS STOCK

Want to sell your business for millions tax-free? It requires special planning, but it is possible for many businesses. Even where 1202 cannot be applied, we have several other strategies to minimize or eliminate taxes on the sale or transfer of your business. Don’t let taxes take a large chunk of what you have built.

BASIS MANAGEMENT

This might sound oversimplified, but managing tax basis is almost unanimously overlooked by advisors. It can mean millions in tax savings when properly managed or millions in inadvertent tax implications when mismanaged.

Meet Our CEO

Todd Phillips is the CEO of Legacy Companies – a private-client tax ecosystem built for real estate investors and business owners who want to reduce tax exposure, increase cash flow, and preserve wealth across generations.

His background as a tax attorney, REIT executive, and strategist has shaped our firm’s approach: we don’t just offer investments, we partner with clients to execute. We also design and implement advanced tax strategies through our proprietary Legacy Blueprints, combining a robust suite of tools under one roof. That includes UPREITs, DSTs, high-depreciation investments, and other integrated solutions.

What we do at Legacy is more than tax planning. It’s a long-term, proactive approach to structuring designed to unlock liquidity, simplify complexity, and future-proof wealth for ultra-high-net-worth families.

More About Us

Legacy Tax Advisors (formerly Nelson Tax & Accounting) is a forward-thinking firm dedicated to delivering a high-end, relationship-driven experience for every client. We specialize in sophisticated tax strategy, advisory, and estate planning services that help individuals, business owners, and family enterprises protect their assets and plan for long-term success.

Built on decades of trusted experience, our team combines deep expertise with cutting-edge technology and fresh perspectives to deliver smarter, more strategic outcomes. Leveraging CEO Todd Phillips’s extensive background in both tax and legal practice, we’re redefining how modern firms approach tax planning. Our firm brings innovation, precision, and insight to every engagement.

At Legacy Tax Advisors, our mission is simple: provide the depth of knowledge and personalized attention our clients deserve while setting a new standard for what a modern tax partnership can be.

Set Up a Call

If you have any questions or inquiries, feel free to contact us through the form or by email.